Credit Union Cheyenne: Exceptional Member Benefits and Providers

Credit Union Cheyenne: Exceptional Member Benefits and Providers

Blog Article

Transform Your Financial Future With Credit Report Unions

Cooperative credit union have been obtaining interest as dependable banks that can favorably impact your economic future. Their distinct structure and member-focused method supply an array of advantages that conventional financial institutions might not provide. By accepting the values of neighborhood, collaboration, and monetary empowerment, cooperative credit union provide an interesting option for people aiming to improve their financial health. As we check out the different methods lending institution can help you achieve your monetary objectives, you'll uncover how these institutions attract attention in the financial landscape and why they might be the secret to changing your future monetary success - Credit Union in Cheyenne Wyoming.

Benefits of Signing Up With a Lending Institution

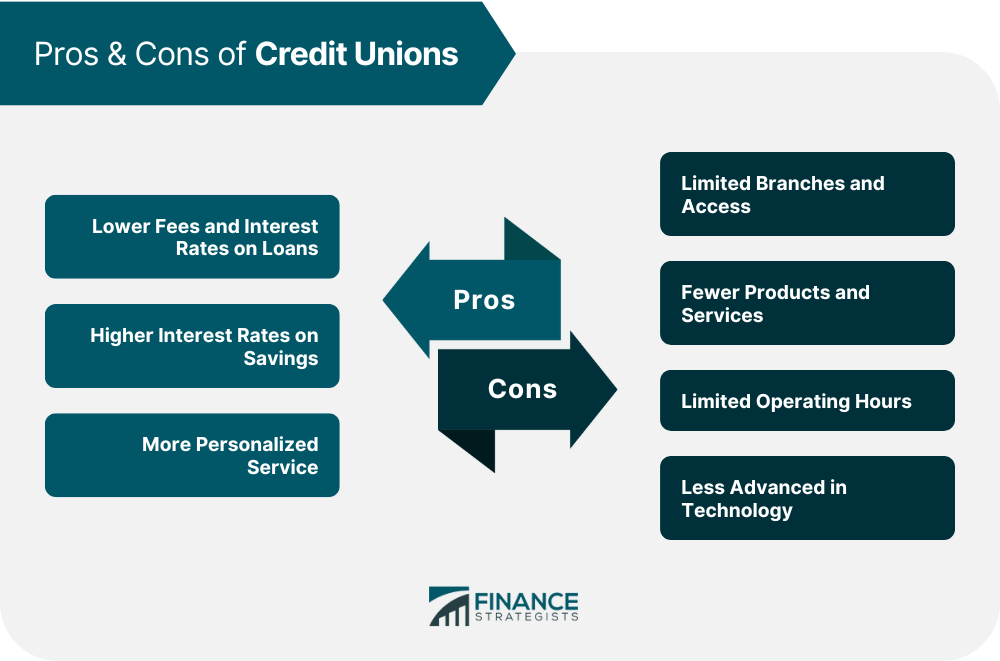

Joining a debt union offers various advantages that can favorably affect your monetary health. Among the key advantages is typically lower fees contrasted to traditional banks. Cooperative credit union are understood for having lower account maintenance fees, lower overdraft fees, and frequently lower rate of interest on loans and bank card. Furthermore, credit report unions are member-owned, not-for-profit financial organizations, which implies they are focused on serving their members instead of producing revenues for shareholders. This member-centric approach commonly equates into better customer care, more customized attention, and a better desire to collaborate with members that might be experiencing monetary difficulties.

Moreover, credit history unions often tend to provide affordable interest prices on savings accounts and certifications of down payment. If they were using a standard financial institution, this can help members expand their savings over time much more successfully than. Many cooperative credit union additionally provide access to monetary education and learning resources, helping members enhance their economic proficiency and make more informed decisions about their cash. On the whole, joining a cooperative credit union can be a wise relocation for individuals wanting to improve their economic well-being.

Savings Opportunities for Members

When taking into consideration banks that focus on member benefits and offer useful rates and services, cooperative credit union attract attention as suppliers of significant financial savings chances for their participants. Cooperative credit union normally supply higher rate of interest on cost savings accounts compared to standard financial institutions, permitting participants to earn much more on their down payments. In addition, lots of credit history unions supply various savings items such as certificates of down payment (CDs) with affordable prices and terms, assisting members expand their cost savings better.

An additional savings possibility lending institution offer is lower fees. Lending institution are recognized for charging less and reduced fees than financial institutions, causing price savings for their participants. Whether it's lower account upkeep fees, atm machine fees, or overdraft account fees, cooperative credit union strive to keep fees marginal, eventually profiting their participants.

Furthermore, cooperative credit union usually supply economic education and learning and counseling solutions to aid members improve their monetary proficiency and make much better conserving choices. By providing these resources, credit score unions equip their members to attain their cost savings goals and protect their economic futures - Wyoming Credit Unions. Generally, credit history unions offer a series of financial savings chances that can significantly benefit their members' monetary wellness

Cooperative Credit Union Loans and Fees

Credit report unions' competitive lending offerings and beneficial interest rates make them a desirable option for participants seeking monetary aid. Unlike standard financial institutions, lending institution are not-for-profit companies owned by their members, permitting them to provide reduced car loan rates and costs. Cooperative credit union supply different kinds of financings, consisting of individual loans, automobile finances, mortgages, and bank resource card. Participants can take advantage of adaptable terms, tailored service, and the chance to construct a strong monetary foundation.

One significant benefit of credit union car loans is the competitive rates of interest they supply. With reduced operating costs contrasted to banks, lending institution can pass on the cost savings to their members in the kind of lowered rate of interest on car loans. Additionally, credit report unions are understood for their personalized method to borrowing, taking into consideration the person's credit score background and financial scenario to provide competitive rates tailored to their needs. By selecting a lending institution for car loans, participants can access cost effective funding options while getting exceptional customer support and support.

Structure Credit History With Lending Institution

To establish a strong credit rating and boost financial standing, collaborating with credit score unions can be a strategic and see helpful approach. Lending institution offer numerous items and services designed to help participants build credit history responsibly. One vital advantage of utilizing cooperative credit union for developing credit rating is their concentrate on individualized solution and member contentment.

Lending institution commonly provide credit-builder lendings, secured debt cards, and financial education resources to assist participants in establishing or repairing their debt profiles. These products are designed to be more obtainable and budget-friendly contrasted to those supplied by typical banks. By making timely payments on credit-builder fundings or safeguarded bank card, individuals can demonstrate credit reliability and enhance their credit report over time.

Moreover, credit report unions commonly take an even more all natural strategy when analyzing debt applications, considering variables past simply credit history. This can be especially useful for individuals with limited credit report or previous economic difficulties. By partnering with a lending institution and sensibly utilizing their credit-building products, people can lay a solid foundation for a safe and secure economic future.

Planning for a Secure Financial Future

An additional key aspect of intending for a safe financial future is constructing an emergency fund. Establishing apart three to 6 months' well worth of living costs in a conveniently available account can offer a financial safety web in situation of unexpected occasions Visit Your URL like work loss or clinical emergency situations.

In enhancement to conserving for emergency situations, it is crucial to assume concerning long-lasting economic objectives such as retired life. Adding to pension like a 401(k) or IRA can help you protect your economic future beyond your functioning years.

Conclusion

In addition, credit rating unions are known for their individualized strategy to borrowing, taking into account the person's credit scores history and monetary scenario to provide affordable rates customized to their needs.To develop a solid credit rating history and enhance economic standing, working with credit unions can be a advantageous and calculated strategy. Credit scores unions offer various items and solutions designed to aid participants develop credit score sensibly.Credit unions commonly offer credit-builder loans, safeguarded credit rating cards, and financial education resources to help members in developing or fixing their credit report profiles.Moreover, credit report unions typically take an even more alternative method when analyzing credit report applications, considering elements past simply credit history ratings.

Report this page